estate tax unified credit amount 2021

Inflation indexing has increased the actual basic exclusion amount to 117 million for 2021 according to a congressional summary of the provision which starts on page 287 of. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

Warshaw Burstein Llp 2022 Trust And Estates Updates

As of 2021 married couples can exempt 234 million.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Formerly Unified Credit Amount. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. The 2022 exemption is 1206 million up from 117 million in 2021.

Prior law provided that the unified credit against the estate tax is the federal unified credit in effect on the decedents date of death but not to exceed the amount allowable as if the federal unified credit did not exceed the tax due on an exclusion amount of 1 million. Now in 2022 the estate tax exemption amount increases to an impressive 12060000 per person and 24120000 per married couple. That said laws change all the time.

Certain GST taxes may be deferred as well. 1977 Quarters 3 and 4 120667. See section 6166i for more information.

Get information on how the estate tax may apply to your taxable estate at your death. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout.

In 2022 it rises to 1206 million. For a married couple that comes to a combined exemption of 2412 million. The previous limit for 2020 was 1158 million.

This is the maximum amount of estate tax that may be paid in installments under section 6166. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. For 2021 the estate and gift tax exemption stands at 117 million per person.

This means that if the total amount you give during your life and at your death is less. The unified credit is a credit for the portion of estate tax due on taxable estates mandated by the. The estate of a New York State resident must file a New York State estate tax return if the following.

The value of lifetime taxable gifts any gifts made in 1977 or later is added to this net amount then reduced by the unified tax credit resulting in the taxable value of the estate. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the. Through December 31 2021.

In 2022 couples can exempt 2412 million. January 1 2019. This tax applies to the combined amount of money you give away during your lifetime and at your death.

The amount of the nonresidents federal gross estate plus the amount of any includible gifts exceeds the basic exclusion. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2021. The unified credit exemption is an exemption from the estate and gift tax.

How Might the Biden Administration Affect the Unified Tax Credit. The 117 million exception in 2021 is set to expire in 2025. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

Is added to this number and the tax is computed. Right now the unified credit exemption is 11 million for single individuals and about 23 million for married couples. In 2021 the estate tax exemption threshold increases slightly to 11700000 per person.

The tax is then reduced by the available unified credit. January 1 2020 through December 31 2020. 2021-2022 Federal Estate Tax Rates.

In 2021 federal estate tax generally applies to assets over 117 million. 1977 Quarters 1 and 2 30000. The unified credit is per person but a married couple can combine their exemptions.

The 2021 federal tax law applies the estate tax to any amount above 117 million. With all amendments enacted on or before July 22 1998. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

The estate tax exemption amount is indexed to inflation and should go up over time. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after- tax assets rather than 1964 million if you made the gift sooner. Qualified Small Business Property or Farm Property Deduction.

Heres a look at the federal estate taxgift tax exemption over the years according to the Tax Policy Center. Estate tax rate ranges from 18 to. Credit Equivalent at 2021 Rates.

The first 1206 million of your estate is therefore exempt from taxation. Under the 2010 Tax Relief Act the lifetime estate and gift tax basic exclusion amount was 5000000 and this. Credit Karma Tax Review.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections. Gifts and estate transfers that exceed 1206 million are subject to tax. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of.

So if your estate does not surpass that threshold you will not face a federal estate tax when your spouse passes. However if you intend to use the marital deduction your partners lifetime exemption is lost. As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax.

18 0 base tax 18 on taxable amount.

What S The Estate Tax Exemption For 2021 Legacy Design Strategies An Estate And Business Planning Law Firm

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Exploring The Estate Tax Part 2 Journal Of Accountancy

Pdf Inheritance Tax Regimes A Comparison

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Foreign Estate Tax For Us Citizens Living Abroad

U S Estate Tax For Canadians Manulife Investment Management

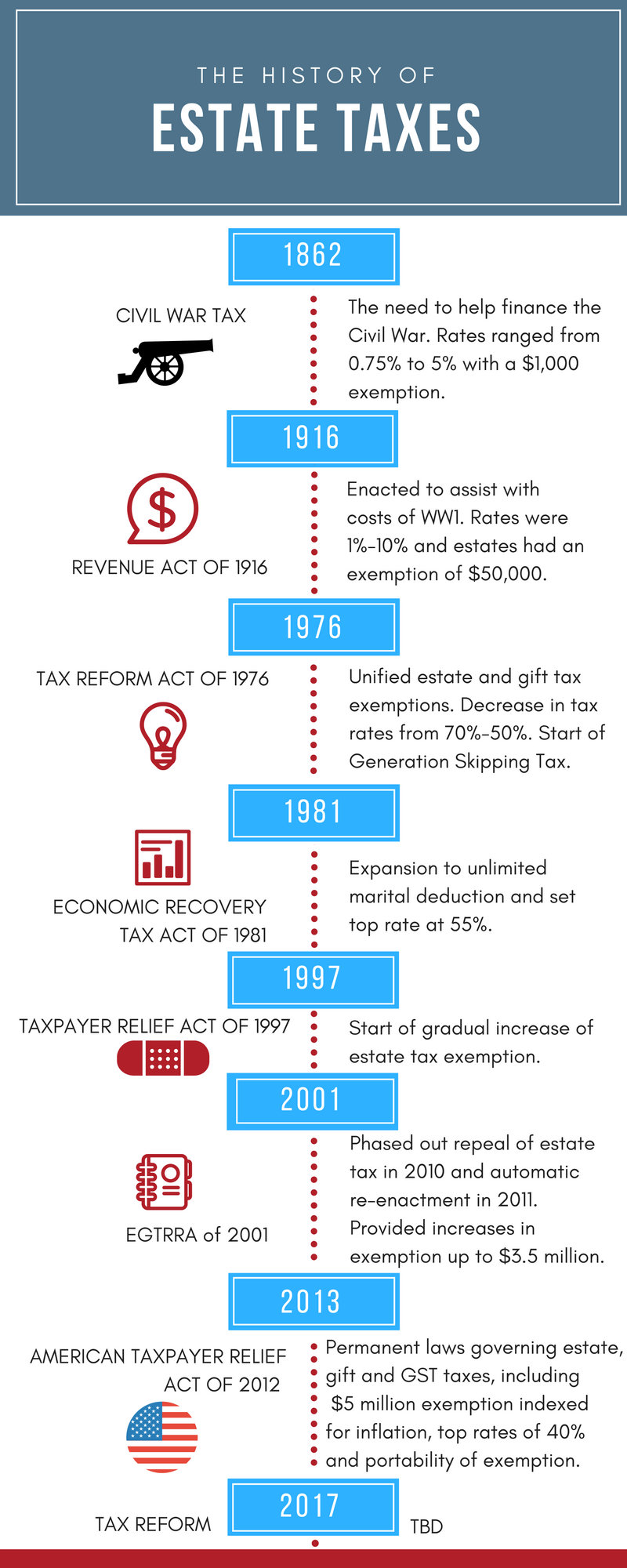

A Brief History Of Estate Gift Taxes

U S Estate Tax For Canadians Manulife Investment Management

U S Estate Tax For Canadians Manulife Investment Management

How To Advise Your Clients Under The New Estate Tax Law Ppt Download