how to declare mileage on taxes

Dasher mileage will be emailed out to all Dashers in the following order. For amounts less than 2500 file your claim.

What Are The Mileage Deduction Rules H R Block

So if you owe 100000 in tax for the current year there would be no penalty if you paid 100 of the tax shown on your return for the prior year even if the tax.

.png)

. Quickly Prepare and File Your 2021 Tax Return. Your mileage from to and from home at the beginning and end of your work day is NOT deductible. This is the easiest method and can result in a higher deduction.

Self-employed workers can claim their mileage deduction on their Schedule C tax form rather than a Schedule A form for itemized deductions. The standard mileage rate lets you deduct a per-cent rate for your mileage. Theres a difference.

The standard mileage rate is currently 056 per mile. If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage. Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

To use this method multiply your total business miles by the IRS Standard Mileage Rate for. All car Dashers in the US that are eligible for 1099 in 2021. As noted above there are certain conditions that qualify taxpayers to.

Connect With An Expert For Unlimited Advice. For the 2021 tax year the rates are. Make Sure You Qualify for Mileage Deduction.

On your self-assessment tax return. Alternatively if you do not file a self. Deduct your employers mileage limit if applicable.

Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses. 56 cents per mile for business miles driven down 15 cents from 2020.

Ad Dont Know How To Start Filing Your Taxes. To determine his mileage deduction he should. Over 50 Milllion Tax Returns Filed.

Ad Dont Know How To Start Filing Your Taxes. How to Log Mileage for Taxes in 8 Easy Steps 1. There are two ways to deduct.

You can deduct any miles that add to the. The total must be calculated using the percent of time the vehicle is used for business. How do I deduct my mileage.

The best way to track your business miles is to write down your mileage at the beginning of the day and the end of the day. Alternately they can claim their. Standard IRS Mileage Deduction.

This rate fluctuates yearly and applies to vehicles including cars trucks and vans. So if you traveled 10000 miles for business purposes for example your deduction would be 5600 10000 miles x. Deducting Mileage In this instance a log would be kept of the mileage used for business and multiplied by.

By Feb 28 2022. Ad From Simple to Advanced Income Taxes. All car Dashers in.

Gather the total number of business miles for the year Multiply that by the standard mileage rate for 2019 Come to a mileage deduction of. Connect With An Expert For Unlimited Advice.

Mileage Tax Deduction Claim Or Take The Standard Deduction

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How To Declare Your Vehicle A Business Vehicle For Taxes Carvana Blog

25 Printable Irs Mileage Tracking Templates Gofar

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Business Mileage Is Tax Deductible

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Template For Excel Everlance

How To Claim Mileage And Business Car Expenses On Taxes

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

What Records Do You Need To Claim A Vehicle Mileage Deduction

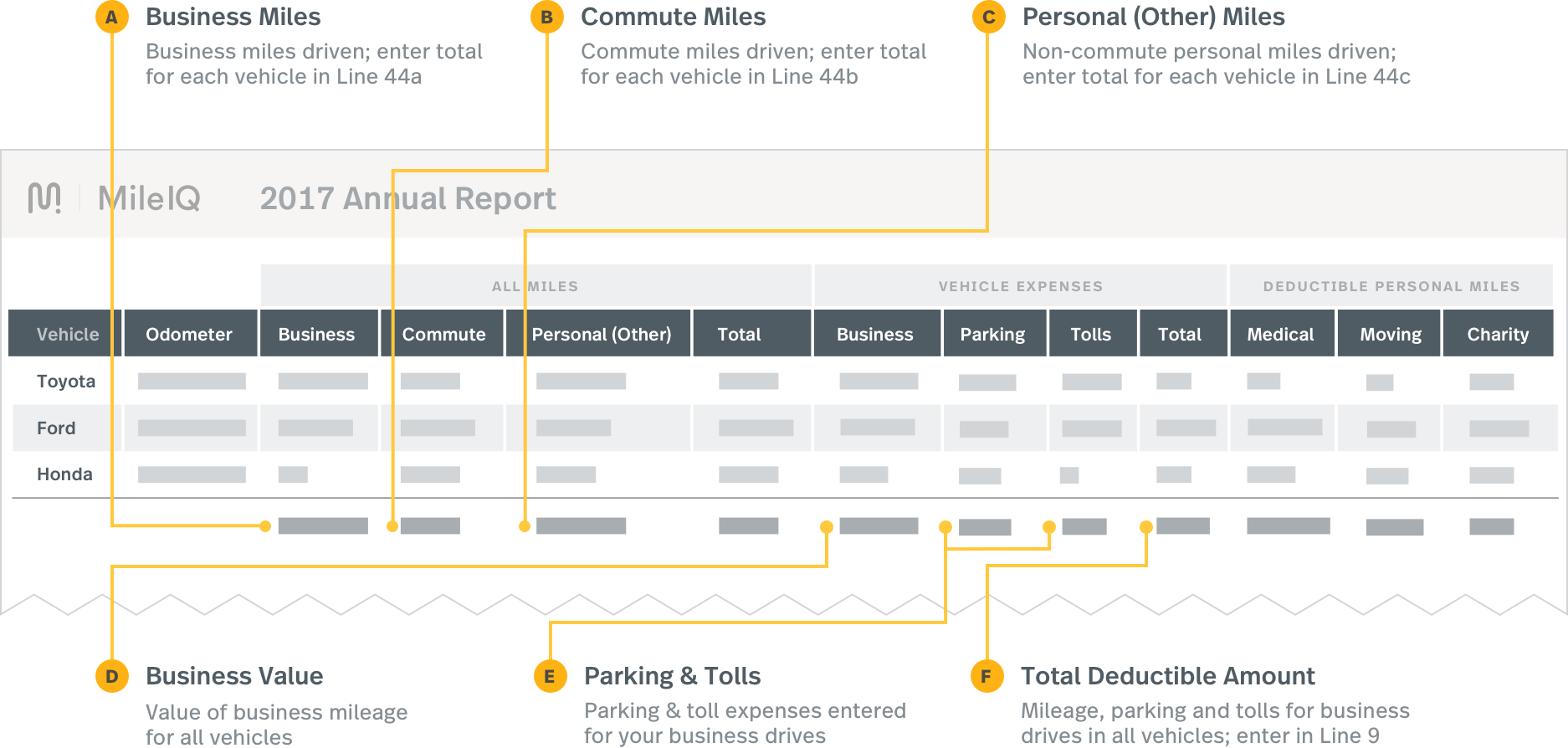

Reporting Mileiq Mileage With Tax Software Mileiq

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

![]()

25 Printable Irs Mileage Tracking Templates Gofar

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms